|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

HARP Program Texas: Key Information and Expert TipsThe Home Affordable Refinance Program (HARP) was a federal initiative designed to help homeowners refinance their mortgages, particularly those who owed more than their home's current value. Although HARP ended in 2018, its impact and principles continue to influence the refinancing landscape in Texas. Understanding the nuances of refinancing can empower homeowners to make informed decisions. Understanding the Basics of HARPHARP was created to assist those struggling with underwater mortgages by allowing them to refinance at lower interest rates. This was particularly beneficial in states like Texas, where housing markets have seen significant fluctuations. Eligibility Criteria

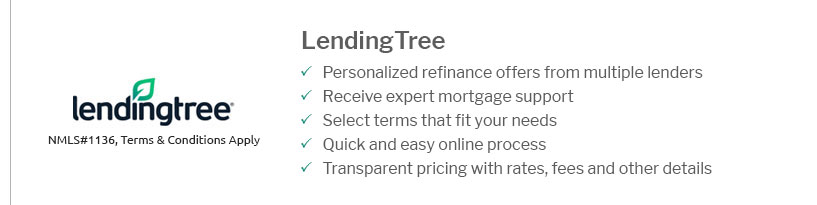

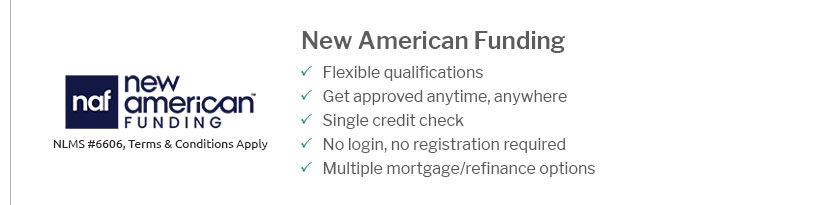

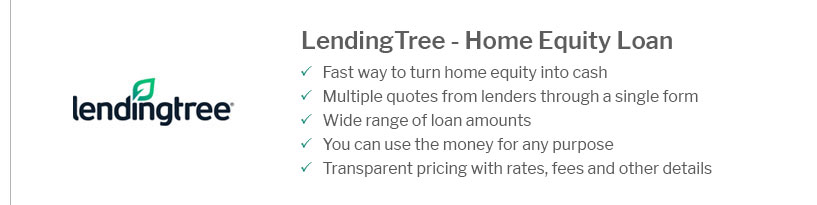

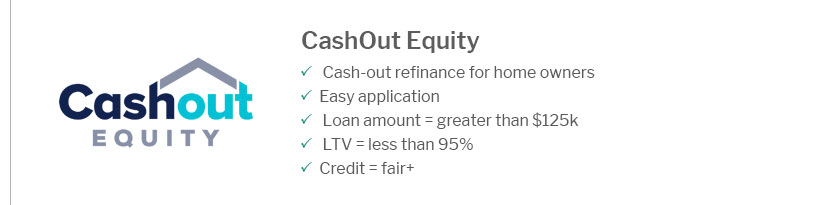

Program BenefitsHARP provided a pathway to lower monthly payments and reduced interest rates, which was a game-changer for many Texans. Refinancing Options Post-HARPAlthough HARP is no longer available, homeowners in Texas have several other refinancing options to consider. Conventional RefinancingThis option is available to those with sufficient equity in their homes and a good credit score. It can offer competitive rates and terms. Government ProgramsPrograms like the FHA Streamline Refinance and VA Interest Rate Reduction Refinance Loan (IRRRL) continue to assist homeowners with specific needs. For those seeking expert advice, exploring the best refinance companies can provide tailored solutions. Expert Tips for Refinancing in Texas

For those in unique situations, such as relocating, learning about options in different regions like the best mortgage lenders hawaii can provide valuable insights. Frequently Asked Questions

https://www.killeenisd.org/harp

The federal McKinney-Vento Homeless Education Assistance Improvements Act and Texas state law protect the rights of homeless children and youth. https://pfd.hhs.texas.gov/hospitals-clinic/hospital-services/hospital-augmented-reimbursement-program

The Hospital Augmented Reimbursement Program (HARP) is a statewide supplemental program providing Medicaid payments to hospitals for inpatient and outpatient ... https://www.glo.texas.gov/disaster-recovery/20182019-harp

Reimbursement up to $50,000 for certain out-of-pocket expenses incurred for repairs including: Reconstruction; Rehabilitation; Mitigation ...

|

|---|